HR Insights for the Future of Work

Be inspired by trends, stories, and smart solutions to cut admin and boost employee engagement.

employee scheduling (26)

HRM (23)

Absence Management (19)

Time-tracking (17)

Payroll (13)

Regulations (12)

Management (11)

Policies (5)

Product Comparison (4)

Product Comparison

Shiftbase vs RotaCloud: Smart Scheduling for UK SMEs Compared

Rinaily Bonifacio

26 November 2025

Regulations

Employment Rights Bill & the End of Exploitative Zero-Hours in Hospitality: Rota Changes SMEs Must Plan Now

Rinaily Bonifacio

26 November 2025

Payroll

How to Cut Labour Costs by 5–10% in UK Restaurants (Without Cutting Staff)

Rinaily Bonifacio

24 November 2025

Product Comparison

Shiftbase vs Papershift: Which Rota Tool is The Best Fit For Your Business?

Rinaily Bonifacio

13 November 2025

Product Comparison

Best Workforce Management Tools for Hourly Employees in 2026

Rinaily Bonifacio

10 December 2025

Product Comparison

Shiftbase vs Dyflexis: Which WFM Tool Fits Hospitality & Retail SMEs Best?

Rinaily Bonifacio

7 November 2025

Regulations

Paid Breaks vs Meal Periods vs Off-the-clock: What’s Legal?

Rinaily Bonifacio

3 November 2025

Payroll

Restaurant overtime FAQ 2026: Who's exempt and who's not and what to do now

Rinaily Bonifacio

10 December 2025

employee scheduling

What’s The ROI of Rota Software? Savings, Benchmarks & Calculator

Rinaily Bonifacio

26 November 2025

Regulations

FAQ: What Actually Counts as ‘Working Time’ For Paid Breaks and Split Shifts?

Rinaily Bonifacio

29 October 2025

Payroll

How to Implement Rolled-Up Holiday Pay For Irregular Hours Staff

Rinaily Bonifacio

29 October 2025

employee scheduling

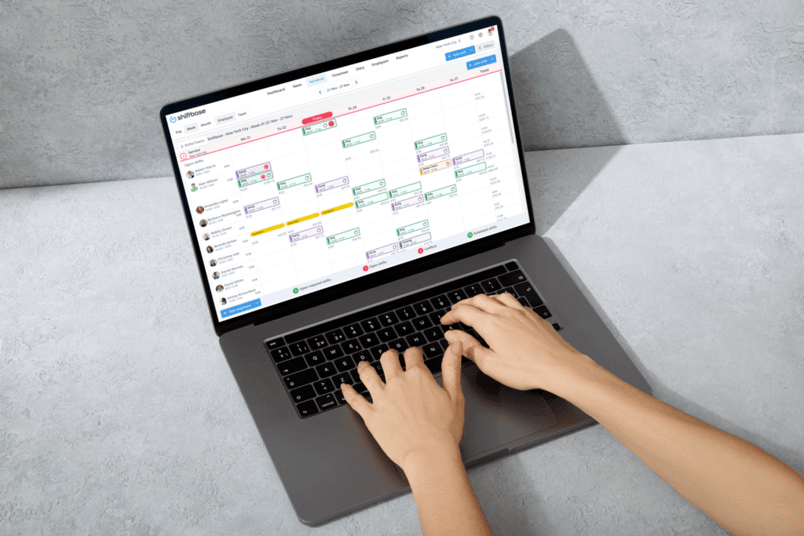

Excel + WhatsApp vs Shiftbase: The True Cost of Rotas, Time Edits and Payroll Errors

Rinaily Bonifacio

26 November 2025