This article looks at the different ways to calculate your hourly rate. We'll also discuss the pros and cons of each method so you can make the best decision for your business.

What is an hourly rate?

An hourly rate is the amount an employee earns for each hour they work. Unlike salaried employees, who receive a fixed amount regardless of the hours they put in, hourly workers are paid based on the actual time they spend on the job.

This setup is common in industries like retail, hospitality, construction, and freelance work—where work hours can vary from week to week.

Why does it matter?

For employers, setting the right hourly rate is key to:

✔ Staying compliant with minimum wage laws.

✔ Managing labour costs effectively.

✔ Ensuring fair pay that attracts and retains talent.

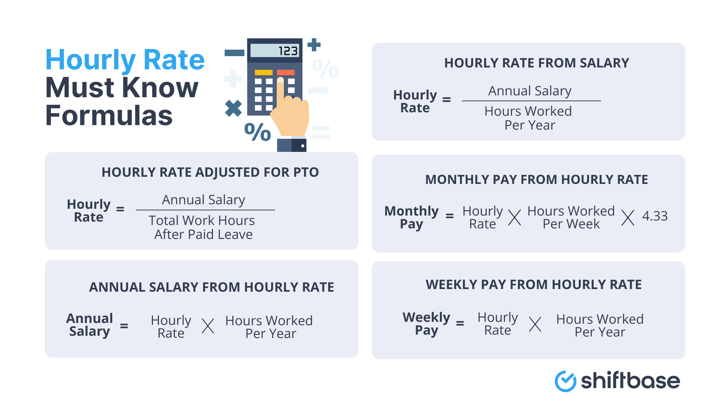

How to calculate hourly rate?

Figuring out an hourly rate isn’t rocket science, but you do need to get it right to avoid payroll headaches. Here’s how it’s done:

➡️ Calculating an hourly rate from an annual salary

If you’re converting a full-time salary into an hourly rate, use this simple formula

Hourly rate = Annual salary / (Number of hours worked per year)

👉 Example: Let’s say an employee has an annual salary of £30,000, and they work 37.5 hours per week (standard full-time hours in the UK).

- Total hours worked per year = 37.5 hours/week × 52 weeks = 1,950 hours

- Hourly rate = £30,000 ÷ 1,950 = £15.38 per hour

➡️ Weekly salary to hourly rate:

This method is used to calculate the hourly rate from an employee's weekly salary. To calculate the hourly rate, divide the weekly salary by the number of hours worked per week.

Hourly rate = Weekly salary / Number of hours worked per week

👉 For example, an employee who earns $1,000 per week and works 40 hours per week would have an hourly rate of $25 ($1,000 / 40 hours).

➡️ Calculating pay for hourly workers

For employees paid on an hourly basis, the formula is even simpler:

Weekly Pay = Hourly Rate × Hours Worked

👉 Example: If an employee earns £12 per hour and works 40 hours a week, their weekly pay is: £12 × 40 = £480 per week

If they work extra hours, overtime rules may apply, which we’ll cover later.

⚠️ Factoring in overtime pay

If employees work beyond their contracted hours, you may need to pay overtime:

- UK: No legal requirement to pay extra for overtime, but the total pay must not fall below the National Minimum Wage.

- US: The Fair Labor Standards Act (FLSA) requires overtime to be paid at 1.5× the regular hourly rate for hours over 40 per week.

👉 Example: If an employee earns £15 per hour and works 45 hours, their overtime pay (for 5 extra hours) would be:

- Overtime rate: £15 × 1.5 = £22.50 per hour

- Overtime pay: 5 × £22.50 = £112.50

- Total weekly pay: (40 × £15) + £112.50 = £712.5

Here is a quick summary table:

| Employee Type | Pay Calculation | Example Calculation |

|---|---|---|

| Salaried Employee | Annual Salary ÷ Total Hours in a Year | £30,000 ÷ 1,950 = £15.38/hr |

| Hourly Worker | Hourly Rate × Hours Worked | £12 × 40 = £480/week |

| Overtime Pay (US) | Hourly Rate × 1.5 | £15 × 1.5 = £22.50/hr |

What exactly does the hourly rate include?

An hourly rate represents the compensation an employer pays an employee for each hour of work. It encompasses all the costs associated with employing that individual, including:

- Base salary: The core compensation for the employee’s time and effort. It reflects the market value of the position and the employee’s qualifications.

- Overtime pay: In most jurisdictions, employees are entitled to overtime pay at a higher rate (typically 1.5 times their regular hourly rate) for overtime hours worked beyond their standard workweek.

- Benefits: Hourly rates often include a portion of the employer’s contribution towards employee benefits, such as health insurance, retirement plans, and paid time off.

- Taxes and deductions: Employers are responsible for withholding taxes from employee wages, including federal, state, and local income taxes, as well as Social Security and Medicare. They may also deduct other authorized deductions, such as health insurance premiums or union dues.

In summary, an hourly rate is not simply the employee’s base pay per hour; it incorporates the entire compensation package, including base salary, overtime, benefits, and taxes.

It represents the overall cost of employing an individual and ensures that the employer is covering all the associated expenses.

How to calculate hourly rate from salary

If you're an employer dealing with payroll, one of the most common calculations you'll need to make is converting an annual salary into an hourly wage. Whether you're budgeting labour costs, determining fair compensation, or figuring out overtime pay, getting this calculation right is essential.

Here’s a step-by-step guide to ensure you don’t miss a thing.

1. The Basic Formula

To calculate the hourly rate from an annual salary, use this simple formula:

Hourly Rate = Annual Salary / Total working Hours in Year

But here’s the catch—working hours aren’t the same for every business. The total number of hours worked in a year depends on:

- Standard weekly hours (e.g., 37.5 or 40 hours per week).

- Whether employees are entitled to paid holidays.

- How many weeks are considered in a full working year.

2. Step-by-step calculation

Let’s go through an example for both a 37.5-hour workweek (UK standard) and a 40-hour workweek (common in the US).

Scenario 1: UK standard

Let’s say an employee earns £35,000 per year, and they work 37.5 hours per week (the standard full-time workweek in the UK).

| Total hours worked per year: |

| 37.5 hours / week × 52 weeks = 1,950 hours |

| Hourly rate calculation: |

| £35,000 / 1,950 = £17.95 per hour |

Scenario 2: US standard

If an employee in the US earns $50,000 per year and works 40 hours per week, their hourly rate is calculated as follows:

| Total hours worked per year: |

| 40 hours / week × 52 weeks = 2,080 hours |

| Hourly rate calculation: |

| $50,000 / 2,080 = $24.04 per hour |

3. Adjusting for paid holidays & unpaid leave

In some cases, employees don’t work the full 52 weeks due to paid time off (PTO), bank holidays, or unpaid leave. To get a more accurate hourly rate, you can adjust for this.

👉 Example: Removing Paid Holidays

If an employee gets 4 weeks of paid holiday, they’re actually working 48 weeks a year instead of 52. The formula changes to:

Hourly Rate = Annual Salary / Total working Hours in 48 weeks

For a UK employee earning £35,000 with a 37.5-hour workweek and 4 weeks of leave, the new total work hours would be:

| Total hours worked per year: |

| 37.5 hours/week × 48 weeks = 1,800 hours |

| New hourly rate calculation: |

| £35,000 / 1,800 = £19.44 per hour |

4. Hourly rate breakdown table

For quick reference, here’s a breakdown of how annual salary translates into hourly wages based on different workweeks:

| Annual Salary (£) | 37.5 hrs/week (1,950 hrs/year) | 40 hrs/week (2,080 hrs/year) | 48-week year (1,800 hrs/year) |

|---|---|---|---|

| £25,000 | £12.82/hr | £12.02/hr | £13.89/hr |

| £30,000 | £15.38/hr | £14.42/hr | £16.67/hr |

| £40,000 | £20.51/hr | £19.23/hr | £22.22/hr |

| £50,000 | £25.64/hr | £24.04/hr | £27.78/hr |

5. Considering employer costs

When setting an employee’s hourly pay, don’t forget employer costs. Even though an employee sees only their gross hourly wage, you as an employer pay additional costs:

- Employer National Insurance Contributions (UK): 15% for salaries above £5,000.

- Payroll Taxes (US): 6.2% for Social Security + 1.45% for Medicare.

- Pension Contributions: Minimum 3% employer contribution in the UK.

- Overtime & Bonuses: If applicable, these should be factored in separately.

6. When to adjust hourly rates

- Overtime Pay: If an employee works beyond their contracted hours, overtime rules apply.

- Annual Raises: Salaries change yearly, so hourly rates should be reviewed regularly.

- Market Competitiveness: If wages in your industry increase, adjusting hourly rates helps retain employees.

How to work out hourly rate UK?

Determining an hourly rate in the UK involves considering various factors, including the employee’s experience, skills, and the specific duties of the job. However, there are two primary methods to calculate an hourly rate:

Additionally, employers must ensure that the hourly rate meets or exceeds the minimum wage set by UK law.

Method 1: Annual Salary to Hourly Rate

This method is suitable for converting an annual salary into an hourly rate. Follow these steps:

Step 1: Determine the annual salary: This is the total annual compensation paid to the employee, typically expressed in pounds sterling (£).

Step 2: Calculate the number of annual hours: In the UK, a standard workweek consists of 37.5 hours. Assuming five working days per week, the annual hours are calculated as follows:

Annual hours = 37.5 hours/week × 52 weeks/year

Step 3: Divide the annual salary by the annual hours: This will give you the hourly rate:

Hourly rate = Annual salary / Annual hours

Method 2: Weekly Salary to Hourly Rate

This method is applicable when you have an employee's weekly salary. Follow these steps:

Step 1: Obtain the employee's weekly salary: This is the total weekly compensation paid to the employee, typically expressed in pounds sterling (£).

Step 2: Calculate the number of weekly hours: Assume the standard workweek of 37.5 hours. Then, divide the weekly salary by the number of weekly hours to determine the hourly rate:

Hourly rate = Weekly salary / Number of weekly hours