In this guide, we’ll break down how time clock rounding works, when it’s legal, and how to avoid costly mistakes while keeping payroll simple.

What is time clock rounding?

Time clock rounding is when you adjust an employee’s clock-in or clock-out time to the nearest set increment (like 5, 10 or 15 minutes) instead of using the exact minute they punched in or out.

Let’s say someone clocks in at 8:03, and your system rounds to the nearest 5 minutes. That time would round back to 8:00. If they clocked in at 8:08, it would round forward to 8:10.

Sounds small, but over time, it can impact total hours worked and pay.

This practice is used to:

-

Keep timesheets tidy

-

Avoid minor timekeeping errors

-

Align with payroll systems

⚠️ But heads up: it mustn’t disadvantage the employee. You’re not allowed to round in your favour every time. In the UK, you still need to comply with National Minimum Wage laws, and in the US, Fair Labor Standards Act (FLSA) rules apply.

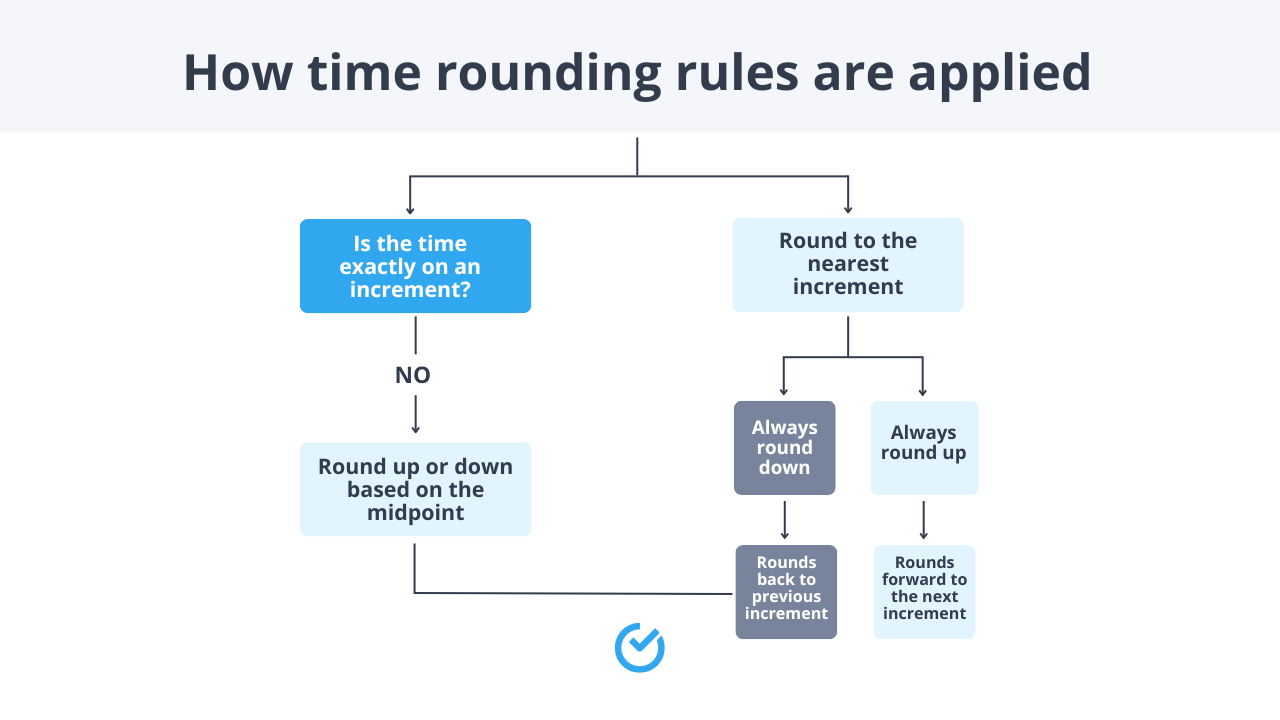

How does time clock rounding work?

Rounding works by setting a rule for how time entries are adjusted. The most common methods are:

1. Round to the nearest increment

-

This is the most balanced method.

-

Rounds time up or down depending on the midpoint.

-

For example:

-

8:02 rounds to 8:00

-

8:07 rounds to 8:05

-

8:08 rounds to 8:10

-

2. Always round up

-

Favourable to the employer, but risky.

-

Often seen as unfair and can breach labour laws if it leads to underpayment.

3. Always round down

-

Favourable to the employee.

-

Less common but some companies use it to be extra generous or avoid disputes.

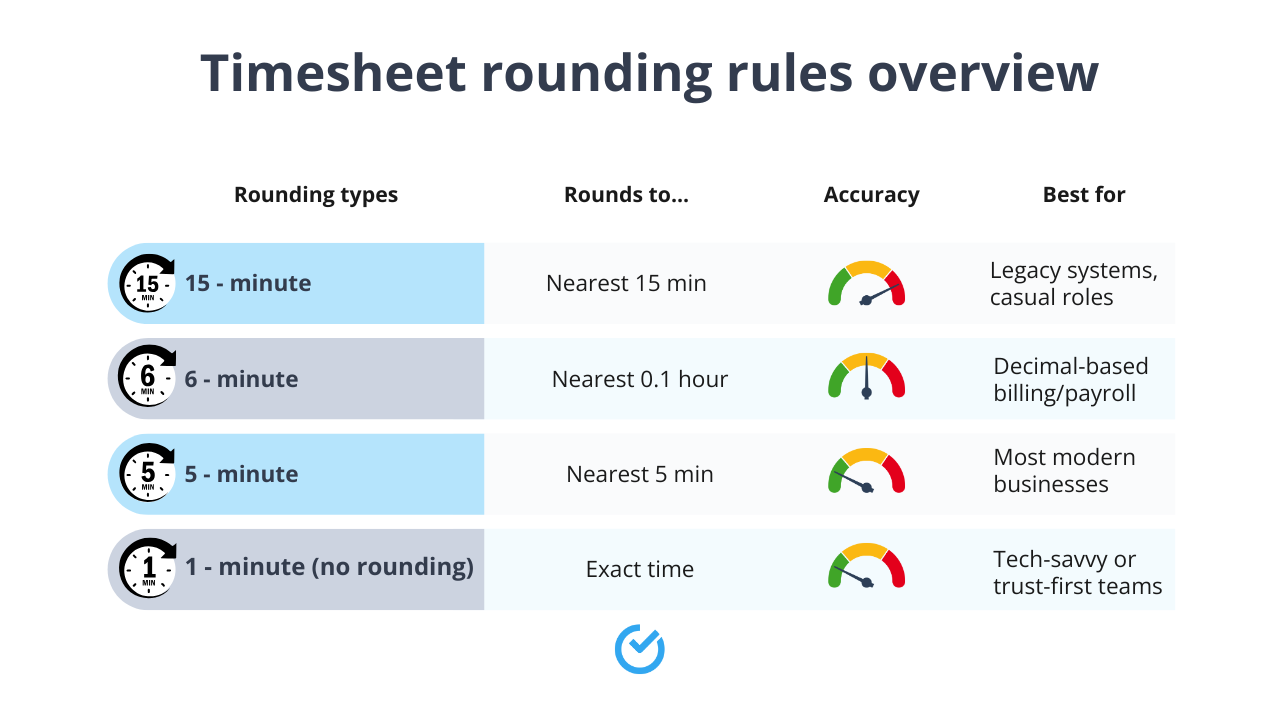

Timesheet rounding rules explained

Rounding isn't one-size-fits-all. There are a few common ways to round time entries, and they each have different pros and pitfalls. Let’s break them down:

15-minute rounding (quarter-hour rounding)

This is the most traditional method; especially in older timekeeping systems.

How it works:

Time is rounded to the nearest 15 minutes.

-

08:00–08:07 ➝ 08:00

-

08:08–08:22 ➝ 08:15

-

08:23–08:37 ➝ 08:30

-

And so on...

Used when:

You want simplicity over precision, and slight time variances don’t affect the job much.

Watch out:

If not done fairly, 15-minute rounding can easily short-change employees, or cost you extra minutes if always rounded up.

6-minute rounding (1/10th of an hour)

Less common, but still used in some payroll systems (especially ones that calculate time in decimals).

How it works:

Every 6-minute block equals 0.1 hours.

-

08:00–08:02 ➝ 08:00 (0.0h)

-

08:03–08:08 ➝ 08:06 (0.1h)

-

08:09–08:14 ➝ 08:12 (0.2h)

-

And so on...

Used when:

You need decimal time for payroll or billing (e.g. consulting, legal, care work).

Watch out:

It’s more precise, but can still feel confusing to employees who expect hour-and-minute formats.

5-minute rounding

This is the most balanced option for many modern businesses.

How it works:

Time rounds to the nearest 5-minute mark.

-

08:01–08:02 ➝ 08:00

-

08:03–08:07 ➝ 08:05

-

08:08–08:12 ➝ 08:10

-

And so on...

Used when:

You want a fair middle ground between clean records and accuracy.

Watch out:

Even this can cause issues if you're always rounding in one direction. Stay neutral.

Other less common options

1-minute rounding

Some businesses now avoid rounding altogether; especially those using modern software. They just pay by the actual minute worked.

Used when:

You want high trust, high accuracy, and minimal admin.

Biased rounding

Some systems round always up or always down.

🚨 Don’t do this. It’s not compliant in most jurisdictions unless it's clearly in the employee’s favour (and even then, it’s risky).

Is time clock rounding legal?

Yes, but only if done fairly and transparently. Time rounding is allowed, as long as it doesn’t short-change employees. That’s the golden rule.

🇬🇧 In the UK:

There’s no law that specifically talks about time rounding. But you still have to follow:

-

The Working Time Regulations 1998

-

National Minimum Wage and National Living Wage rules

-

Accurate timekeeping expectations from HMRC

If rounding causes staff to be paid below minimum wage or to miss breaks they’re legally entitled to, you're on thin ice.

🇺🇸 In the US:

Under the Fair Labor Standards Act, rounding is allowed if it’s neutral. That means:

-

It doesn’t consistently benefit the employer

-

It averages out over time

-

It doesn’t result in unpaid overtime

⚠️ Note: In some US states like California, courts are now saying even neutral rounding might be risky; especially if exact time records are available. So if you’re in the US, always check state-specific laws.

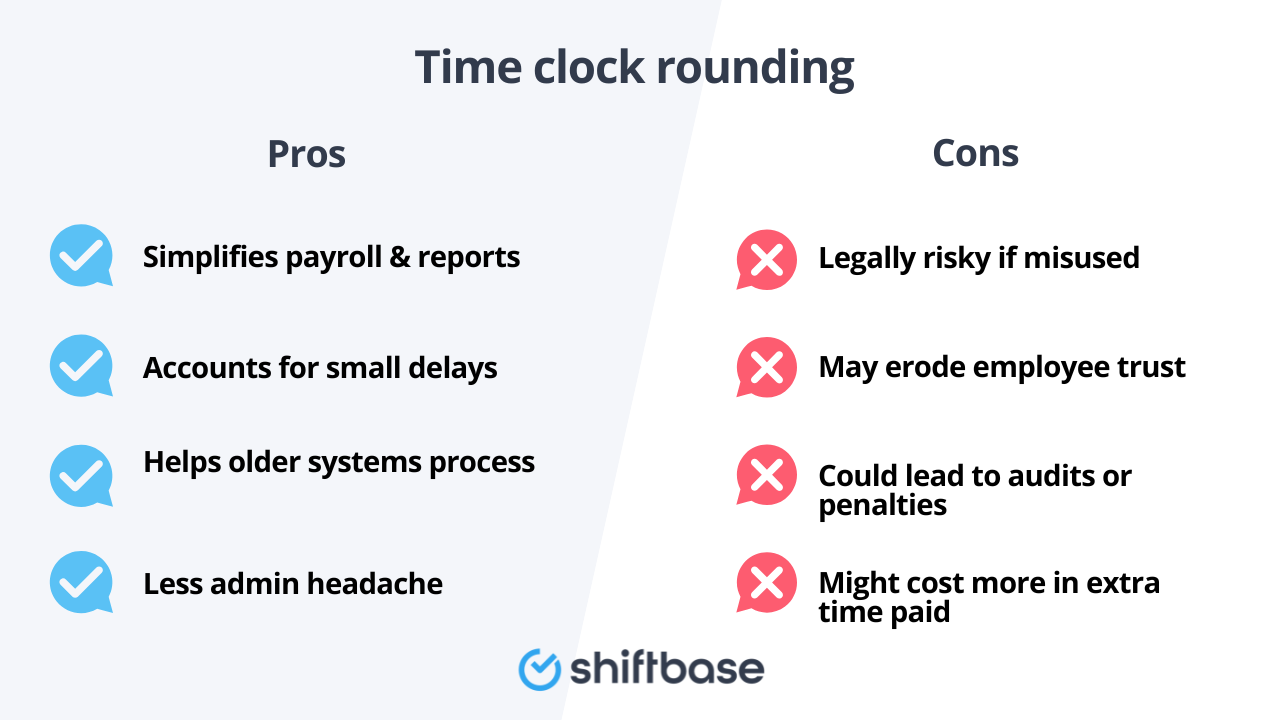

Pros and cons of time clock rounding

Time clock rounding can make payroll life easier or turn into a legal headache if you’re not careful. Here's what to consider:

👍 The pros

- Cleaner timesheets: You avoid messy timestamps like 08:01, 08:02, 08:03… That makes reports easier to read and faster to process.

- Speeds up payroll: Your payroll team or software doesn’t have to calculate in awkward minute chunks. This can save serious admin time if you’re running payroll weekly.

- Handles early/late punches fairly: People don’t always clock in at the exact scheduled time. Rounding can account for small variances without penalising anyone.

- Works well with legacy systems: Some older payroll systems still need round numbers. Rounding can help bridge the gap until you modernise.

👎 The cons

- Legal risks if used unfairly: If rounding consistently reduces hours worked or underpays minimum wage, you’re in trouble; especially in the UK (with HMRC) or in strict US states like California.

- Loss of employee trust: Even small deductions can create resentment. If workers feel you're shaving time to save money, morale takes a hit.

- Can trigger audits: If an employee complains to HMRC or the US Department of Labor, and you can’t show the exact timestamps or prove neutrality, you could face penalties.

- Doesn’t always save money: If you’re rounding up for every employee (say, to the nearest 15 minutes) those minutes add up fast, especially with a large team.

Best practices for using time clock rounding

If you’re going to round, do it right. These best practices will help you avoid legal trouble, payroll headaches, and staff complaints.

Be fair and neutral

This is non-negotiable. Always round both up and down. For example, if you're rounding to the nearest 5 minutes:

-

08:02 rounds down to 08:00

-

08:03 rounds up to 08:05

If your system only rounds in your favour, that’s illegal in most cases and a quick way to lose trust.

Document your rounding policy

Put your rounding rules in writing, so everyone’s on the same page. Your policy should include:

-

What increment you use (5, 6, or 15 minutes)

-

How rounding is applied (nearest, up, down)

-

A statement that rounding is neutral and compliant

-

Who to contact if employees have questions

⚠️ Add this to your employee handbook or onboarding docs.

Train your managers

Supervisors should understand:

-

How rounding works

-

When it’s applied

-

What to do if an employee raises a concern

If they can't explain it clearly, it’ll look like you’re hiding something.

Keep original timestamps

Even if your system shows rounded hours on payslips, keep the raw punch-in and punch-out data. This protects you in audits, disputes, or wage investigations.

Audit your rounding data

Every few months, run a report:

-

Are employees losing time more often than gaining it?

-

Does one location or manager round differently?

-

Are rounding rules consistent across teams?

If the pattern’s off, it might be time to tweak your setup.

Be transparent with staff

Let employees see their clock-in and clock-out times, not just the rounded totals. It builds trust and gives them a chance to flag errors early.

Alternatives to time clock rounding

Not sure if rounding is right for your team? Good news: there are other ways to keep time tracking fair, simple, and compliant, without fiddling with minutes.

| Alternative | What it is | Best for |

|---|---|---|

| Grace period | Buffer zone around start/end time | Shift-based workplaces |

| Flexible start time | Range to start work anytime | Office/admin teams |

| Lockout rules | Prevents early/late punches | Hour-sensitive roles, compliance |

| Transparency with data | Showing raw vs. rounded hours | Any business using rounding |

Rounding isn’t the only game in town. If it’s causing headaches (or making you nervous about compliance) try grace periods, flexible start times, or lockout rules instead. The right choice depends on your team, your tech, and how tightly you need to control the clock.

The goal? A system that’s fair, consistent, and clear for everyone, without making your payroll team lose sleep.

How Shiftbase helps you manage time rounding the smart way

If you’re using spreadsheets or outdated systems to track time, rounding can easily spiral into confusion, or worse, compliance risks.

With Shiftbase, you can set up automated, transparent rounding rules that are consistent across your entire team. No guesswork, no manual editing.

Here’s how we make it easier:

-

Built-in time tracking logs exact timestamps, so you always have raw data when you need it

-

You can customise rounding rules by location or role, without losing accuracy

-

Managers can monitor punches in real time and approve changes quickly

-

Employees get full visibility into their hours, improving trust and reducing disputes

And because Shiftbase also includes powerful employee scheduling and absence management, you’ll save time across the board — not just on payroll.

🎯 Ready to simplify your time tracking and stay compliant with less stress?

Try Shiftbase free for 14 days and see how much smoother your workforce management can be.