Understanding compensable time is essential for HR managers and employers to ensure compliance with labor laws and accurate payroll processing; this article will provide comprehensive insights into its various aspects.

What is compensable time?

Compensable time refers to the hours that employees must be paid for under labor laws. According to the Fair Labor Standards Act (FLSA), compensable time includes all hours worked by employees that benefit the employer, even if the work was not authorized. This includes time spent on tasks such as waiting, on-call time, travel related to work, and specific breaks.

Importance of compensable time

Understanding compensable time is crucial for compliance with the Fair Labor Standards Act and other labor laws. Accurate tracking and compensation ensure that employees receive fair pay, including minimum wage and overtime. Failure to properly account for compensable time can lead to payroll errors, legal issues, and penalties from the Department of Labor. Employers must be diligent in tracking all compensable hours to avoid lawsuits, back wages, and other financial consequences.

Employees covered by compensable time

Different categories of employees are affected by compensable time under the Fair Labor Standards Act (FLSA).

FLSA non-exempt employees

Non-exempt employees under the FLSA are entitled to compensation for all hours worked, including overtime pay at one and a half times their regular rate for hours exceeding 40 in a week. These employees are typically paid hourly and include workers in various industries such as retail, hospitality, and manufacturing. The FLSA requires that employers must compensate non-exempt employees for time spent on job-related activities, including certain waiting periods, travel time, and on-call time.

FLSA exempt employees

Exempt employees, on the other hand, are not covered by the same compensation requirements as non-exempt employees. These employees typically include those in executive, administrative, and professional roles who are paid a salary rather than an hourly wage. Exempt employees do not qualify for overtime pay regardless of the number of hours worked. This exemption is based on specific criteria, including job duties and salary thresholds, as defined by the FLSA. Employers must be clear about these distinctions to ensure compliance with federal law and avoid potential legal issues.

Activities included in compensable time

Various activities are considered compensable under the Fair Labor Standards Act.

Engaged waiting time

Employees must be compensated for waiting time if they are required to stay on the employer's premises or be ready to work at short notice. This engaged waiting time is part of the hours worked because the employee is not completely relieved from duty.

On-call at work

When employees are on call at their job site, they must be compensated. If they are required to stay on the employer's premises or close enough to respond to calls within a specific time frame, this on-call time is considered hours worked.

Short breaks

Short breaks, typically lasting about 5 to 20 minutes, are considered compensable time under the FLSA. Employers must pay employees for these rest periods as they count towards the total hours worked.

Working during breaks

If an employee works through their break, whether voluntarily or at the employer's request, that time must be compensated. This includes performing job responsibilities or work-related activities during meal periods or short breaks.

Sleeping time

For employees required to be on duty for 24 hours or more, sleeping time can be compensated. Up to eight hours of sleeping time may be excluded from compensable hours if adequate sleeping facilities are provided and the employee can enjoy an uninterrupted sleep.

Travel time

Travel time is compensable in specific scenarios. If travel is part of an employee's principal activity, such as traveling between job sites during the workday or for a special one-day assignment in another city, it must be paid. Commuting from home to work and back is generally not considered compensable time.

Activities not included in compensable time

Certain activities are not considered compensable time under the Fair Labor Standards Act.

Non-engaged waiting time

Waiting time is not compensated if employees are completely relieved of duties and are free to use the time for their own purposes. For example, if an employee is waiting for a task to be assigned and can leave the job site during this period, this non-engaged waiting time is not considered hours worked.

On-call at home

On-call time spent at home is generally non-compensable if employees can use this time freely and are not significantly restricted. As long as employees are not required to remain on the employer's premises or close enough to be ready to respond immediately, this on-call time is not considered compensable hours.

Meal break

Meal breaks of 30 minutes or more are typically not compensable if the employee is completely relieved from duty during this period. Employers do not need to pay for these breaks as long as employees are not performing any job-related activities or work duties during their lunch breaks.

Commuting

Commuting time, or the time spent traveling from home to work and back, is generally not compensable under federal law. This applies to normal work hours and does not count as hours worked. However, travel involved in special one-day assignments in another city or travel during the employee's scheduled shift may be considered compensable time.

Common confusions regarding compensable time

Several situations often lead to confusion about whether the time should be compensable.

Training, lectures, and seminars

Training, lectures, and seminars are considered compensable time if attendance is mandatory or if the event is directly related to the employee's job. If these activities occur during normal working hours or the employee is required to attend, then the time must be paid. Conversely, voluntary attendance outside of regular working hours does not require compensation.

Volunteering and social activities

Volunteering and social activities can be tricky when determining compensable hours. If an employee volunteers for an event that is not related to their job responsibilities or is outside of normal work hours, this time is generally non-compensable. However, if the activity is job-related or the employee is required to participate, it must be compensated as hours worked.

Time waiting for medical attention

When employees need medical attention for an on-the-job injury, the time spent waiting for and receiving medical care is considered compensable time. This includes time spent at the job site or a medical facility during their regular working hours. Employers must pay employees for this time, ensuring compliance with federal law and proper compensation for the employee's time spent on work-related activities.

How to calculate compensable time

Accurately calculating compensable time is essential for ensuring fair employee pay.

Hourly wage basis

For hourly employees, compensable time includes all hours worked during the normal workday. This encompasses regular working hours, short breaks, and any time spent on work-related activities, including engaged waiting time and travel time between job sites. Employers must ensure that employees are paid at least the federal minimum wage for all compensable hours worked.

Overtime compensation

Overtime compensation applies when non-exempt employees work more than 40 hours in a week. According to the Fair Labor Standards Act (FLSA), these employees must be compensated at one and a half times their regular hourly wage for any hours worked beyond the standard 40-hour workweek. This calculation includes all compensable hours, such as on-call time at work and time spent on job-related activities. Proper tracking and calculation of overtime are crucial to comply with FLSA requirements and avoid potential back wages or penalties.

Tools and methods for tracking compensable time

Effectively tracking compensable time is crucial for ensuring accurate payroll and compliance with labor laws.

Time tracking software

Using time tracking software offers numerous benefits for accurately tracking employee hours. These tools can automatically record hours worked, calculate overtime, and differentiate between compensable and non-compensable time. Software solutions help employers ensure compliance with the Fair Labor Standards Act (FLSA) and other regulations, reducing the risk of payroll errors and potential legal issues. Additionally, these tools often provide detailed reports and analytics, making it easier for HR managers to monitor employee hours and manage payroll efficiently.

Manual tracking methods

Manual tracking methods, such as paper timesheets or punch clocks, have traditionally been used to record employee hours. While these methods can be effective, they come with limitations. Manual tracking is prone to errors, time theft, and inaccuracies, making it challenging to ensure all compensable hours are correctly recorded.

Additionally, manual methods can be time-consuming and difficult to audit, leading to potential discrepancies in payroll. For these reasons, many employers are transitioning to digital time tracking solutions to improve accuracy and compliance.

Useful Read: What Are the Time Clock Rules for Hourly Employees? A Guide

Legal implications of failing to compensate time

Failing to properly compensate employees can lead to significant legal consequences.

Potential lawsuits

Employers who do not pay employees for all compensable time may face potential lawsuits. Employees can file claims for unpaid wages, which can result in costly legal battles. These lawsuits often include claims for unpaid overtime, rest periods, meal breaks, and other compensable hours. Employers found guilty of failing to compensate employees correctly may have to pay back wages, legal fees, and damages.

Department of Labor investigations

The Department of Labor (DOL) conducts investigations to ensure compliance with the Fair Labor Standards Act (FLSA). If an investigation reveals that an employer has not compensated employees for all hours worked, the DOL can impose penalties and require the employer to pay back wages. These investigations can be triggered by employee complaints or routine audits and can have serious implications for non-compliant employers.

Penalties and back pay

Non-compliance with federal law regarding compensable time can result in substantial financial penalties. Employers may be required to pay back wages for all hours worked that were not properly compensated, including overtime. Additionally, they may face fines and interest on unpaid wages. Penalties can be severe, especially for repeated violations, highlighting the importance of adhering to FLSA requirements.

Best practices for managing compensable time

Implementing best practices can help employers effectively manage compensable time and ensure compliance.

Clear policies and communication

Establishing clear policies regarding compensable time is essential. Employers should clearly define what constitutes compensable hours, including on-call time, rest and meal periods, travel time, and sleeping time. Communicating these policies to all employees ensures that everyone understands their rights and responsibilities.

Regular audits and reviews

Conducting regular audits and reviews of time tracking practices helps identify and correct potential issues. Employers should routinely check that all hours worked, including short breaks and job-related activities, are accurately recorded and compensated. Regular audits help maintain compliance with the Fair Labor Standards Act and local laws.

Training for HR and management

Providing training for HR managers and supervisors is crucial for ensuring they understand compensable time rules. Training should cover the FLSA requirements, the importance of accurate time tracking, and the legal implications of failing to compensate employees properly. Well-informed HR and management teams are better equipped to implement and enforce compensable time policies effectively.

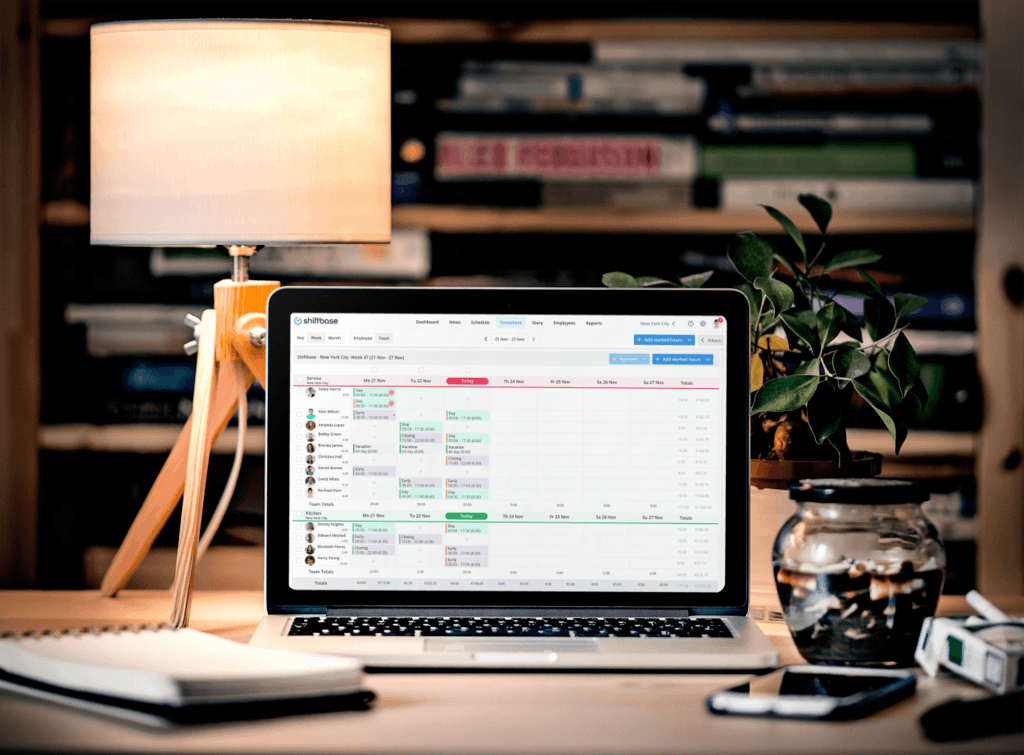

Simplify compensable time management with Shiftbase

Managing compensable time accurately is crucial for compliance and payroll accuracy. Shiftbase, a leading SaaS for workforce management, offers robust employee scheduling, time tracking, and absence management features. With Shiftbase, you can easily track work hours, manage rest and meal periods, and ensure compliance with labor laws, including the Fair Labor Standards Act.