Rotas in Excel and shift changes in WhatsApp feel quick, until payday goes sideways. Managers re-key times, correct rates, chase screenshots, and explain why the wage bill doesn’t match the rota. The hidden cost isn’t just admin time. It’s payroll errors, compliance gaps, and frustrated staff across multiple sites.

This blog shows the real cost of Excel + WhatsApp versus Shiftbase. You’ll get a simple way to measure re-keying minutes, an error-rate sampling method, and a clear formula to translate mistakes into money. We’ll cover compliance basics, why off-channel messaging creates risk, and which features actually prevent errors. You’ll also see a 30-day rollout plan and an ROI example for a three-site group.

Why this comparison matters in 2025

One year of “small fixes” now adds up to real money and compliance exposure.

The risk landscape has changed

Payroll accuracy is under pressure. EY reports the average employer makes 15 payroll corrections per pay period, with an average $291 (£230) direct cost per incident, before counting lost time or fines.

In the UK, rolled-up holiday pay for irregular and part-year workers went live for leave years starting 1 April 2024, changing how many SMEs calculate and evidence holiday pay. That’s manageable in a system, but brittle in spreadsheets and chat logs.

In the US, predictive scheduling continues to spread across cities and states, bringing notice periods, predictability pay and recordkeeping duties that punish last-minute rota changes.

Quick snapshot:

| Pressure | What it means for SMEs |

|---|---|

| More payroll corrections | Admin rework + higher wage bill variance. |

| UK holiday pay reforms | New evidence trail for irregular/part-year workers. |

| US predictive scheduling | Costly premiums for late changes; stricter records. |

💡Takeaway: If your rota lives in Excel and changes run through WhatsApp, your risk is growing—fast. You can centralise rotas, time and pay rules in Shiftbase to keep evidence and edits in one place.

The true cost of spreadsheet rotas

Spreadsheets look cheap until the error bill shows up.

Error rates you can’t see

Independent research highlights how fragile spreadsheets are: 94% used in business decision-making contain errors. In rota files, mistakes show up as two types: quantitative (wrong numbers; hours, rates, totals) and qualitative (wrong logic; misapplied formulas, outdated rules). Copy/paste “fixes” and hidden cells create formula creep, so one incorrect reference quietly ripples into overtime, premiums and holiday pay.

👀 Spot the risks (checklist)

-

VLOOKUP/XLOOKUP ranges updated this month?

-

Hidden columns/rows turned back on before export?

-

Pay rules (OT, rolled-up holiday) version-controlled?

-

Who audited last pivot/total against time clock data?

⚠️ If you hesitated on any line, errors are likely.

What errors do to payroll

Here’s the chain: rota error → time edit → payroll correction. EY’s survey found 15 corrections per pay period on average, with direct costs around $291 each and significant indirect time spent reprocessing. For a 150-person, multi-site team running bi-weekly payrolls, that’s thousands a quarter, before morale and trust costs.

Why WhatsApp groups break compliance and control

Good intentions aside, WhatsApp is a shadow system for rotas.

Shadow IT, data retention and evidence risk

The UK ICO’s worker-monitoring guidance stresses lawful, transparent handling of staff data and clear records; hard to prove when schedule changes live in private chats. Tribunals now routinely accept WhatsApp screenshots as evidence, and reports show a sharp rise in cases citing WhatsApp messages. That’s a governance headache for any employer relying on group chats for shifts.

What can go wrong (real cases)

-

Group-chat “banter” treated as misconduct: dismissal upheld.

-

Informal work chats blur boundaries and fuel disputes.

Regulated sectors show the fines

Financial firms have paid hundreds of millions for off-channel messaging and recordkeeping failures (texts, WhatsApp, iMessage). Different industry, same lesson: if work decisions happen off-system, you must capture and retain the record or pay for it.

Public-sector guidance is clear

UK Cabinet Office guidance permits non-corporate channels only if decisions and information are promptly transferred to official systems; a principle SMEs can copy for rota changes and shift swaps.

What “good” looks like for scheduling and timekeeping in 2025

Here’s the baseline a modern system should hit without workarounds.

Core capabilities checklist

You want fewer edits, clean evidence, and exports that just work. At minimum, look for:

-

Real-time time clocks (web, mobile, kiosk) with exceptions flagged automatically.

-

Audit trails for every rota and time edit (who, what, when).

-

Role-based access so managers see only their sites and teams.

-

Automated premiums/OT (night, Sunday, split shifts, on-call) baked into the rules engine.

-

Integrated messaging linked to the shift, not a chat silo.

-

API payroll exports with validation before transfer.

Quick self-check

-

Can you show who changed a shift and why?

-

Can you prove a premium or OT was auto-applied, not hand-typed?

-

Can you export a clean, validated file per site in one click?

Region-specific must-haves

-

United Kingdom: From 1 April 2024 leave years, rolled-up holiday pay is permitted for irregular hours/part-year workers; you still need an evidence trail of accrual and payment. Keep Working Time and minimum-wage records that clearly show time worked and pay outcomes.

-

United States: FLSA recordkeeping (29 CFR Part 516) requires specific time and pay records; several jurisdictions add predictive scheduling duties (advance notice, premiums for late changes, recordkeeping). Systems should track notice dates, edits and premiums automatically.

The options on the table

Before diving into costs, here’s how each approach typically looks for a three-site team.

Excel + WhatsApp — how SMEs actually use it

Typical setup: Shared rota spreadsheet (OneDrive/Google Drive) + WhatsApp groups for swaps, sickness, last-minute changes.

Good for: very small teams, short-term fixes, low edit frequency.

Watch-outs: spreadsheet error risk, SAR/GDPR retrieval pain, RTI penalties if data is late/wrong, time-theft exposure.

Feature snapshot

-

Rota templates: manual

-

Shift swaps: WhatsApp threads

-

Time capture: manual entry

-

Approvals/audit: limited

-

Payroll export: copy/paste or CSV

-

Multi-site view: separate files/tabs

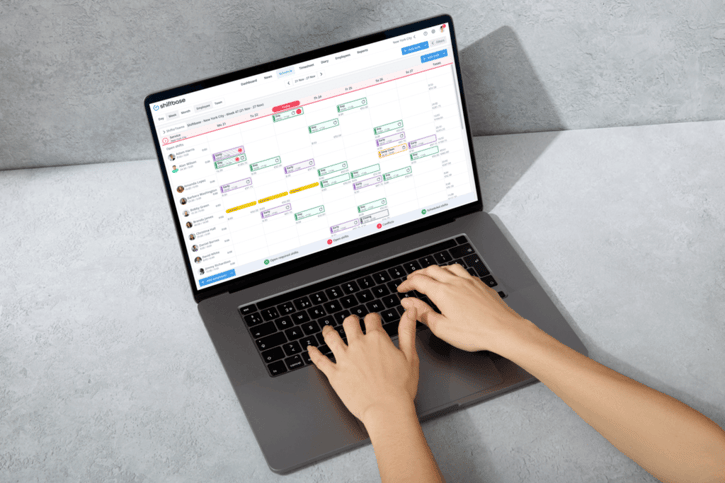

Shiftbase — all-in-one rota, time, payroll data

Typical setup: Central rota per site, mobile clock-ins, in-app swaps/availability, absence tracking, export to payroll.

Best for: 3+ sites, frequent changes, compliance needs, growing teams.

Feature snapshot

-

Rota templates: built-in

-

Shift swaps: request/approve in app

-

Time capture: mobile/web punch

-

Approvals/audit: full change logs

-

Payroll export: structured

-

Multi-site view: single source of truth

A practical workflow comparison

The same week, two workflows: how a 3-site team moves from manual rotas and chats to templates, approvals and clean payroll.

Scheduling a week across 3 sites

- Excel + WhatsApp: duplicate last week’s sheet → adjust per site → DM swaps in WhatsApp → re-enter changes → resend.

- Shiftbase: load site template → auto-suggest coverage → staff request swaps in app → manager approves → rota updates instantly.

Time edits & approvals

-

Excel + WhatsApp: staff message “left at 18:10” → manager edits sheet → no change log.

-

Shiftbase: employee submits edit → manager approves/declines → change is logged & visible.

Payroll hand-off

- Excel + WhatsApp: export CSVs, merge tabs, check formulas, fix mismatches → submit RTI.

- Shiftbase: run hours report → export to payroll format → spot-check exceptions → submit RTI.

Quick comparison (features, costs, time saved)

| Category | Excel + WhatsApp | Shiftbase |

|---|---|---|

| Direct cost | £0 licences | Per-employee subscription |

| Manager time on rotas/week | 6–10 hrs (manual, chat chasing) | 2–4 hrs (templates, approvals) |

| Payroll corrections/month | Higher likelihood | Lower via audit/export |

| Error likelihood | High in real-world sheets | Reduced with controls |

| GDPR/SAR effort | High (chat/device sprawl) | Lower (central records) |

| Multi-site control | Fragile (files/tabs) | Strong (single source) |

💡Useful Read: What’s The ROI of Rota Software? Savings, Benchmarks & Calculator

Measuring your hidden costs: a simple field study you can run

Spend one pay period gathering data; you’ll know exactly what Excel + WhatsApp is costing.

Re-keying minutes baseline

For the next pay run (all three sites):

- Log touches per shift from rota → time → payroll (create, edit, approve, export).

- Time each touch in minutes.

- Sum per site and divide by shifts to get minutes per shift.

Use a simple sheet with columns: Site, Shift ID, Touch Type, Minutes, Reason. Aim for a full week’s rota.

Error-rate sampling

Randomly sample 5–10% of shifts across sites. For each sampled shift, check:

-

Hours (planned vs actual), pay rate, premiums/OT, absence coding.

Classify each discrepancy and compute errors per 100 shifts. Keep screenshots or audit IDs so you can trace the cause (spreadsheet formula, manual edit, missing premium).

Sampling cheat-table:

| Metric | Target method |

|---|---|

| Sample size | 5–10% of total shifts |

| Error classes | Hours, rate, premium/OT, absence |

| Output | Errors per 100 shifts + top 3 root causes |

Translate to money

Use EY’s benchmarks to turn findings into pounds/dollars:

-

Direct cost per payroll correction: about $291 (£230) each.

-

Average corrections per pay period: 15 per employer.

Formula: Estimated cost per period = (# corrections) × $291 + (admin hours on corrections × hourly cost)

Annualise by multiplying by your pay periods. If your sample found 8 errors per 100 shifts and you run 600 shifts per period, expect ~48 corrections—that’s $13,968 direct cost before admin time.

💡Takeaway: Once you see your own numbers, the fix pays for itself. Shiftbase reduces re-keying and flags exceptions early, so those “corrections” never reach payroll.

Save hours each week—try Shiftbase now

Ready to see the difference in your own rota and payroll? Shiftbase brings your rotas, time edits and approvals into one place—so you spend fewer hours chasing chats, make fewer mistakes at payroll, and stay audit-ready across all three sites. Try Shiftbase free for 14 days and benchmark it against your current setup this month: Start your free trial.

Frequently Asked Questions

-

No. But employers must meet GDPR duties (data minimisation, retention, access requests). Lawyers and the ICO highlight risks without clear policies, audit ability and controlled data. If you rely on WhatsApp groups, implement policy, consent and retrieval processes—or move to a system with built-in messaging/audit.

-

Very. Multiple field audits found the majority of real-world spreadsheets contain serious errors; in several studies, around 90%+ had issues. Error cascades make bottom-line totals unreliable without rigorous checks.

-

HMRC can issue penalties for late RTI submissions and inaccuracies; guidance explains thresholds and escalation. Repeated lateness or errors increase risk. Avoid by tightening inputs and using cleaner exports from time/attendance systems.

-

When your weekly rota/correction hours and payroll fixes exceed the licence cost—especially across multiple sites with frequent swaps. Add any avoided penalties/time-theft leakage to the benefit side for a conservative ROI view.