HR Insights for the Future of Work

Be inspired by trends, stories, and smart solutions to cut admin and boost employee engagement.

employee scheduling (26)

HRM (23)

Absence Management (19)

Time-tracking (17)

Payroll (13)

Regulations (12)

Management (11)

Policies (5)

Product Comparison (4)

Product Comparison

Shiftbase vs RotaCloud: Smart Scheduling for UK SMEs Compared

Rinaily Bonifacio

26 November 2025

Regulations

Employment Rights Bill & the End of Exploitative Zero-Hours in Hospitality: Rota Changes SMEs Must Plan Now

Rinaily Bonifacio

26 November 2025

Payroll

How to Cut Labour Costs by 5–10% in UK Restaurants (Without Cutting Staff)

Rinaily Bonifacio

24 November 2025

Product Comparison

Shiftbase vs Papershift: Which Rota Tool is The Best Fit For Your Business?

Rinaily Bonifacio

13 November 2025

Product Comparison

Best Workforce Management Tools for Hourly Employees in 2026

Rinaily Bonifacio

8 December 2025

Product Comparison

Shiftbase vs Dyflexis: Which WFM Tool Fits Hospitality & Retail SMEs Best?

Rinaily Bonifacio

7 November 2025

Regulations

Paid Breaks vs Meal Periods vs Off-the-clock: What’s Legal?

Rinaily Bonifacio

3 November 2025

Payroll

Restaurant overtime FAQ 2025: Who's exempt and who's not and what to do now

Rinaily Bonifacio

30 October 2025

employee scheduling

What’s The ROI of Rota Software? Savings, Benchmarks & Calculator

Rinaily Bonifacio

26 November 2025

Regulations

FAQ: What Actually Counts as ‘Working Time’ For Paid Breaks and Split Shifts?

Rinaily Bonifacio

29 October 2025

Payroll

How to Implement Rolled-Up Holiday Pay For Irregular Hours Staff

Rinaily Bonifacio

29 October 2025

employee scheduling

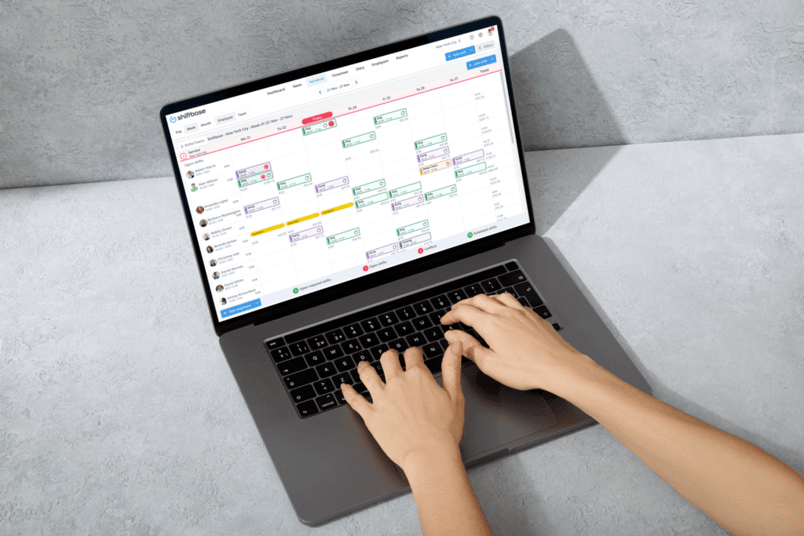

Excel + WhatsApp vs Shiftbase: The True Cost of Rotas, Time Edits and Payroll Errors

Rinaily Bonifacio

26 November 2025